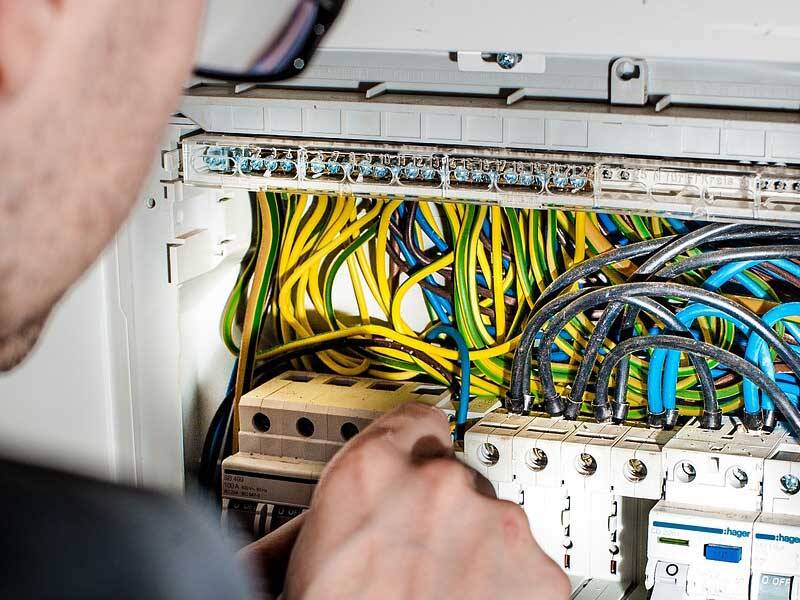

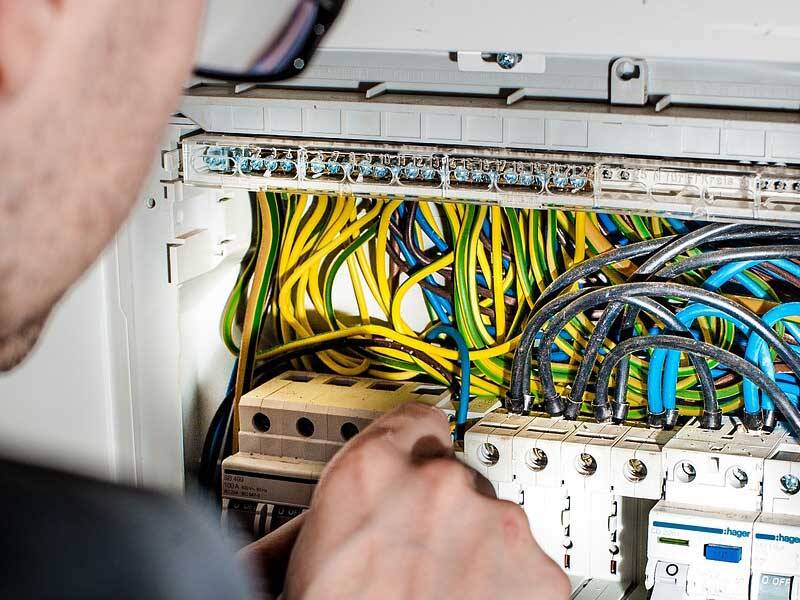

Under the Construction Industry Scheme (CIS), contractors are required to withhold a portion of payments to subcontractors and send these amounts to HMRC. It is crucial for contractors to register for CIS and file monthly returns to keep HMRC informed about these deductions.

While submitting CIS Returns is a vital task for all construction contractors, we know it can often be a daunting process. Our dedicated service is designed to eliminate the stress of CIS return submissions, allowing you to concentrate on what you excel at while we take care of the details. Having collaborated with countless contractors in the construction industry, we assure you that you are supported by a firm that comprehensively understands your specific circumstances and the pressures you face.

Talk to us about construction industry scheme

Call us to book a FREE consultation on 03332 241 209 and see how we can support your business!

Related Services

Corporation Tax Returns

Corporation tax is a significant expense for most businesses, and getting it wrong can lead to severe penalties and the high costs associated with tax investigations. We provide corporation tax returns in London and Manchester.

Personal Tax Returns

Our team adopts a comprehensive strategy with our annual tax return compliance service in London and Manchester. We makes use of advanced technology and encompasses much more than just filing tax returns.

VAT Returns

VAT is a complex tax that requires expert guidance to navigate its many nuances. The initial question to consider is whether you need to register for VAT.

Construction Industry Scheme

Under the Construction Industry Scheme (CIS), contractors are required to withhold a portion of payments to subcontractors and send these amounts to HMRC.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.